Following the introduction of the favourable tax regime in 2013, employee ownership trusts (“EOTs”) have become an increasingly popular model for succession of a business, and a possible alternative to other conventional methods for business owners looking to exit. An EOT can provide a way to sell shares in a trading company in a tax efficient manner, as well as an enduring structure which can work well to reward and engage with employees, protect the culture and legacy of a business and preserve this for the benefit of employees going forwards. As of 2024, well over a thousand businesses are reported to have transitioned to employee ownership, including those operating in a range of sectors, particularly professional services, manufacturing, construction and retail.

How an Employee Ownership Trust works

In broad terms, an EOT is a specific type of trust which is set up to hold shares in and control a trading company for the benefit of all of the employees of a business.

As long as certain requirements are met (below), there are two key tax reliefs that apply to EOT transactions, in particular:

- Shareholders selling their shares to an EOT can do so free of capital gains tax; and

- Thereafter, certain tax-free bonuses can be paid to employees

Shares are owned indirectly on behalf of the employees by a group of trustees, or as is often the case, a limited company set up for this purpose, with a group of directors who act as a de facto board of trustees. Employees do not own the shares directly, but have an interest in the company indirectly through the trust holding shares on their collective behalf.

The operating companies will continue to be run and managed by a board of directors, and can generally continue business without any significant changes or interference.

Where relevant, a more targeted share incentive scheme can be operated alongside an EOT. Specific employees can be offered direct shareholdings in an EOT owned company, including under another tax advantaged share scheme like the EMI Scheme, as long as the EOT retains control of the company.

Benefits and Limitations of Employee Ownership

Advantages:

For the current shareholders:

- Shareholders can realise the value built up in the business; and consideration will generally reflect the market value of the shares.

- Generally no capital gains tax on disposals to a qualifying EOT, subject to the relevant requirements being met.

- Process can be funded in a tax efficient way out of the accumulated and future profits of the companies.

- Structure provides flexibility for the vendors to remain involved in the business, which can help with the transition of ownership.

- Shareholders can potentially retain a minority shareholding in the company, albeit the existence of the EOT shareholder may adversely affect the value of residual shareholdings (as across).

- Can provide a means to exit in situations where there are limited external options available.

For the business and employees:

- Employee ownership can be rewarding for staff, and can provide better protection for staff than would be the case in a trade sale.

- The legacy, core values and culture of a business can be protected.

- Profits can be reinvested or shared amongst employees.

- Tax free bonuses of up to £3,600 (per person per annum) can be paid to all employees, and surplus profits remain available for reinvestment or distribution amongst employees.

Limitations:

- Consideration will generally be payable to the shareholders over a number of years.

- Consideration will generally be paid out of the accumulated and future profits of the company, which can place strains on company cash flow.

- Company needs to have a suitable operating infrastructure and management structure to ensure the business can continue to operate effectively, even after the sellers have exited.

- Certain conditions must be met in order to qualify for the relevant capital gains tax reliefs, and these must be met for 4-5 years after the transaction, and indefinitely thereafter (see below).

- It is generally challenging (or expensive) unwinding an EOT structure, given the high burden of tax that will often arise in that scenario.

- The value and marketability of any shares retained by the vendors or other individuals may be reduced.

- EOT itself does not necessarily provide a means to incentivise specific employees and so supplemental arrangements will need to be made (for example, targeted bonus or other incentive schemes), which can add complexity into the structure.

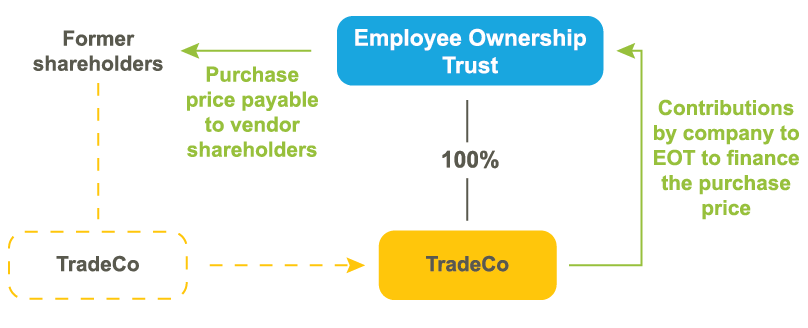

EOT Structure and Funding

In general terms, the process of implementing an EOT is as follows:

- The EOT is established by the company; and

- The shareholders sell their shares to the EOT for consideration which will generally reflect the market value of the shares and include:

- An amount of cash payable at or around completion; and

- An amount of cash consideration payable over an extended period.

In some cases, the company makes an initial contribution of funds to the EOT, and will make further contributions over time, which are used to repay the outstanding purchase price. In some cases, the trustees or company may choose to borrow (from a third party) to expedite payments to the vendors

Key Qualifying Conditions

Certain conditions must be met in order to qualify for the relevant capital gains tax reliefs to apply:

- The company must be a trading company or the holding company of a trading group

- The EOT must obtain control of the company.

- The EOT must be tax resident in the UK

- The number of shareholders who are also directors/employees must be less than 40% of the total number of employees

- The trust must be established for the benefit of all employees, on terms that must be broadly equal, except that certain former shareholders and their relatives must be excluded. The trustees can distinguish and provide different benefits to employees based on remuneration, length of service and hours worked (and the companies can continue to remunerate employees, on a commercial basis, as appropriate), but otherwise any benefits must be on equal terms

- The trustees must take all reasonable steps to ensure that the consideration does not exceed market value, which as a minimum, will generally warrant an independent valuation being obtained

- The vendor shareholders must not control the trustee board or the companies

- The relief is only available to individuals, and does not apply to companies

- The shares must be ordinary shares, and the individual must not have claimed relief in respect of any prior disposals of shares in the same company

The relevant conditions must be met for at least 4 years from the end of the tax year in which the EOT is established and acquires the company, otherwise the relevant capital gains tax reliefs will be withdrawn.

The relief conditions must also be met indefinitely thereafter, as a breach of the requirements after that initial period has elapsed will crystallise tax charges for the trustees, which can still be significant for them, as well as for the business and potentially on the trustees’ if this impedes their ability to pay any of the purchase price still outstanding.

Employee ownership can be relevant for all kinds of businesses, and whilst the tax reliefs strictly only apply to sales of companies, the structure can still work well for other types of businesses, including partnerships, as well as for companies that are part of a larger group, with some prior restructuring. Some preliminary restructuring may also be relevant for companies which do not immediately meet the requirements for the capital gains tax reliefs, for example those which have non-trading assets or elements, or if there are separate specific assets that will not be acquired by the EOT.

Looking for an EOT valuation?

How can we help?

Menzies have supported a number of businesses and their owners in assessing the appropriateness of employee ownership as a model for succession, as well as in the implementation EOT structures, where relevant.

In the right circumstances, an EOT can be an effective tool to facilitate a transition of ownership to employees, and for the current shareholders to sell their shares in a tax efficient manner. An EOT will, however, not suit every business, and it is important that careful consideration is given to the appropriateness and practicalities, to ensure this not only meets any immediate objectives of the shareholders, but is also sustainable. This is particularly important in light of the legislative changes introduced from October 2024, which impose stricter requirements, and extend the period during which the capital gains tax relief can be withdrawn if the considerations are subsequently breached. Whether this is the right structure will depend on the specific circumstances, and a number of factors.

Buying and selling your business

Our team of specialist tax advisers have extensive experience advising on buying and selling businesses, including disposing of shares to employee ownership trusts. We can assist with:

Initial Feasibility Analysis

- Advising on the appropriateness of employee ownership for your business, or where relevant, we can also advise on any alternative succession strategies that might be relevant to achieve your objectives.

- Assessing the feasibility of selling shares to an employee ownership trust.

- Financial modelling and forecasting.

- Advising on governance arrangements, business strategy, systems and processes, and working with you generally to ensure that the employee ownership model is viable and sustainable.

Planning and Structuring

- Tax structuring advice, designing the process and preparing a steps plan.

- Alongside our other specialist teams, advising on business valuations and financing strategies.

- Coordinating with HMRC to obtain any relevant clearances.

- Advising on supplemental employee share schemes and/or other incentivisation strategies, as relevant.

Implementation, Communication and Reporting

- Providing transactional support, review of legal documentation from a tax perspective and working with any other advisers to implement the transactions.

- Assisting with communication to key stakeholders and employees.

- Dealing with associated administration, reporting, disclosures, elections and relief claims.

- Providing practical, commercial and technical input to support in the implementation of complex transactions.

- Accounting for EOT transactions, and assisting with any associated reporting requirements in respect of the companies, the trust and the vendor shareholders.

Our Insights

Employee ownership trusts: key tax changes and…

Rising interest in employee ownership as a succession strategy Over the past two years, we…