Investing in cryptoassets is becoming more commonplace, but only 42% of crypto owners were aware there might be tax to pay when using crypto in a survey commissioned by HMRC in 2022. Even when taxpayers are aware a liability might exist, it’s not always clear which tax is chargeable.

What counts as a taxable event?

A transaction can fall within the scope of tax in the following circumstances:

- Making and receiving payments in crypto

- Receiving employment salary in crypto

- Earnings from mining, staking and airdrops

- Disposals of investments in crypto

- Returns on investments in crypto

- Buying and selling crypto

In addition to the above, some common pitfalls include:

- Some don’t realise that crypto is not a currency. Exchanging one type of crypto for fiat currency or another cryptocurrency is therefore not the same as, for example, exchanging GBP for USD. Exchanging cryptoassets means you have disposed of one and acquired another, therefore giving rise to a taxable transaction. The same happens if you buy goods or services with crypto – this is a disposal of your cryptoassets and therefore a taxable transaction.

- Even if your activity is minimal and you don’t see purchasing crypto as an investment, you are likely to have tax to pay if you make a profit when you dispose of any cryptoassets.

- It’s not always clear what type of income you receive if you make a profit. A profit made during a taxable event might count as a trade, miscellaneous income, or most likely a chargeable gain.

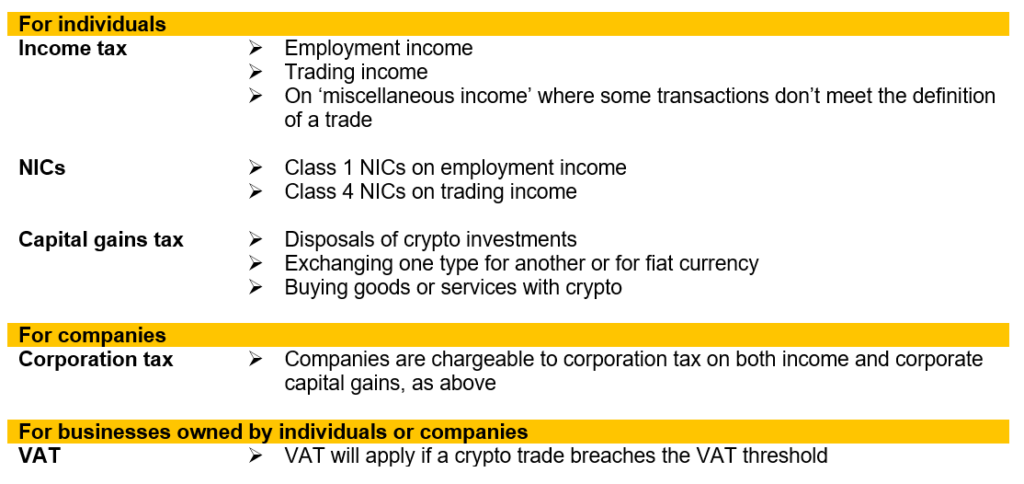

What tax will I have to pay?

There are ongoing consultations regarding what tax crypto should be chargeable to, but for now we are reliant on the existing HMRC guidance and cryptoassets manual as change to tax legislation is not expected imminently.

Very broadly, you might expect certain transactions to be taxable as follows:

It is always worth seeking advice as the guidance and legislation will continue to evolve over time.

Do I have a crypto trade?

Whether activity counts as a trade can depend on a number of factors, but HMRC advise that most crypto activity is unlikely to qualify as a trade due to the frequency, level of organisation and sophistication that is required for the activity to amount to a trade. HMRC will consider the ‘badges of trade’ in the round and not rely on any one factor, so it is important to consider this carefully with an adviser if you think you might have a crypto trade.

If there is a trade, income tax takes priority over capital gains tax. Otherwise, capital gains tax will apply where a disposal of cryptoassets takes place.

For activities such as mining, staking and airdropped tokens, HMRC advise that income tax would still apply even where these activities do not amount to a trade, as instead profits from these activities would be classified as ‘miscellaneous income’. The main difference is that NICs is not chargeable on miscellaneous income.

What do I do if I haven’t disclosed historic crypto transactions to HMRC?

If you think you have taxable transactions that have not been disclosed to HMRC, the best thing to do is come forward. Unprompted disclosures carry lower penalties than if you are prompted by HMRC first.

If the time limit to file or amend a tax return is still open, this would likely be the most appropriate way to correct any errors or omissions.

Where the time limit has run out, a voluntary disclosure under the Digital Disclosure Service might be the most appropriate way of rectifying your tax position if any errors or omissions were not deliberate.

In cases of dishonest and deliberate behaviour, the Contractual Disclosure Facility or Code of Practice 9 process may be available to use.

If you are worried about undisclosed tax liabilities due to your crypto activities and would like specialist advice to help you bring your tax affairs up to date, get in touch with the Tax Disputes and Disclosures team at Menzies on our free hotline below: