Businesses are in the midst of a hugely uncertain time, with a combination of increasing energy costs, interest rates and supply chain uncertainty. As a result, it is becoming increasingly challenging to forecast earnings to produce a valuation.

ESTIMATING FUTURE MAINTAINABLE EARNINGS

The most commonly used valuation method for a trading entity is the Capitalisation of Earnings approach. In short, this entails multiplying the Future Maintainable Earnings (“FME”) by an appropriate multiple. This multiple is often obtained from a review of comparable companies and transactions.

A fundamental component to the valuation therefore is estimating, as robustly as possible, an appropriate FME. Traditionally, in the absence of accurate and sensible forecasts, the concept of ‘maintainable’ has often focused on historical financial results as a basis for estimating the future, adjusting for extraordinary items and events that are not likely to be repeated.

Business owners face many challenges in the current climate. Covid-19, Brexit, and the fallout from the September 2022 Mini-Budget means that less reliance can be placed on historic financial results when determining a suitable FME.

THE EFFECTS OF RISING ENERGY COSTS ON VALUATIONS

Certain geo-political circumstances have led to a surge in energy costs. From a valuation perspective, the impact to the underlying value of a business can be enormous. This impact will be more acutely felt by companies with high levels of premises expenditure, such as those with large warehouses or energy-intensive manufacturing processes. But it also impacts the suppliers, distribution costs and the demand from customers who are also experiencing price shocks.

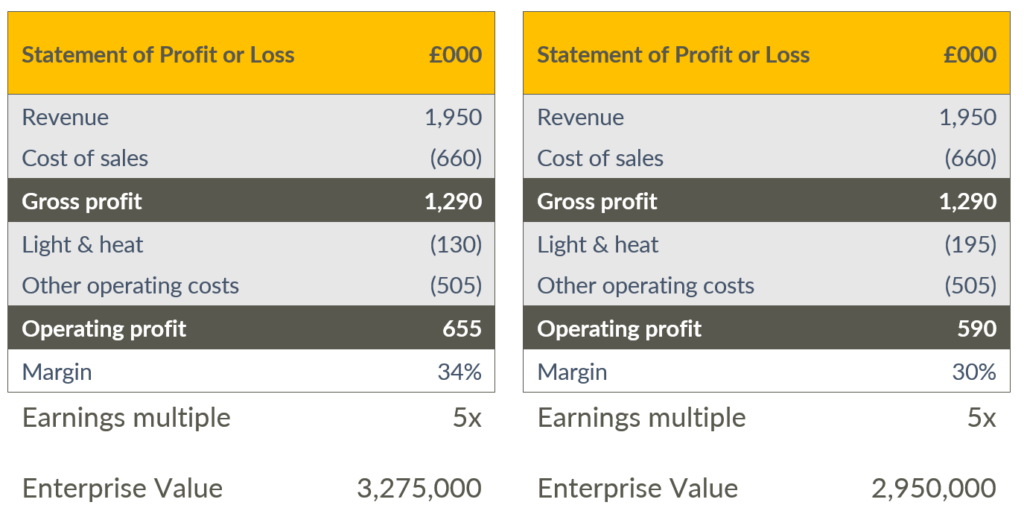

As an example, we can take a hypothetical manufacturing business which is seeing increased energy costs. It must either pass on the costs to customers, absorb the cost and reduce its margins, or a combination of the two. As a valuation would typically be based on a multiple of earnings, the impact of increasing costs could be significant, as shown in the below example.

The manufacturing business had revenue of £1.95m, cost of sales of £660k, energy costs of £130k, and other operating costs of £505k, amounting to operating profit of £655k and a margin of 34%. The relevant earnings multiple is 5x which gives an Enterprise Value of £3.275m (£655k x 5).

If we take a conservative estimate of a 50% increase in commercial energy prices, the operating profit and margin fall by £65k and 4% respectively. By taking the same earnings multiple of 5x, the Enterprise Value then falls to £2.950m (£590k x 5); a drop of £325k compared with the previous value. An example that clearly shows the effects that rising energy costs are having on valuations.

THE EFFECTS OF DISTRIBUTION ON VALUATIONS

There have also been far-reaching consequences to supply chains across the world as a result of Covid-19. The pandemic has led to huge fluctuations in demand, with consumer behaviour altering rapidly, due to constant changes in measures brought in to reduce the spread of infection. Distribution companies have struggled to plan ahead, which has often led to a shortage in long haul shipping containers. This has created a backlog in orders that are still being worked through, and a premium being added to prices. As well as this, certain countries have enforced strict protocols in response to the pandemic, which has delayed international haulage further.

Companies distributing and selling physical goods to international customers may have seen a sharp drop in their revenue from previous years, due to new limitations in exporting products to certain markets. Even international markets without additional limitations are likely to have become more expensive to ship to, especially when taking account of rising energy prices.

Additionally, companies importing goods as part of their production process will likely have been forced to source from new, often more expensive, international or domestic suppliers.

Alternatively, companies that remained with their international suppliers are likely to experience a rise in shipping costs. From a valuation perspective, using historic data to determine FME for businesses heavily impacted by the above is unlikely to be accurate without significant adjustment and consideration for changing market conditions. Alternatively, detailed forecasts that have considered these changes could be more representational of FME.

THE EFFECTS OF INTEREST RATES ON VALUATIONS

Rising inflation, along with the adverse market response to the Government’s September 2022 Mini-Budget has led to a sharp increase in interest rates. Accordingly, financial institutions face increasing interest costs.

The more debt leveraged a company is, the more adversely affected it will be in dealing with the fallout. Companies such as those holding properties that are financed by loans, and those with assets purchased under finance leases, will need to cover additional costs with an impact on their profit margins. Alternatively, those with high cash reserves may see an increase in the level of interest received.

When valuing a majority shareholding of a company, it would typically be valued using a multiple of EBITDA (Earnings before interest, tax, depreciation and amortisation). This would therefore exclude interest paid or received from the calculation of Enterprise Value, however the underlying profitability of the company will undoubtedly have changed and therefore its risk profile changes with it.

HOW CAN WE ASSIST YOU?

Whether the valuation is required for taxation, strategic, or commercial purposes, Menzies are well placed to assist you in determining a robust company valuation.

Our team have worked within a variety of accounting and tax backgrounds, having completed valuations on businesses operating across many different sectors. We have specific industry knowledge, that will enable us to locate areas requiring further analysis, and potential alternations to FME and therefore, overall value.

CONTACT OUR VALUATION EXPERTS

For further information on our valuation services, or to discuss your specific circumstances, please contact one of our specialists via the contact form below: