At a time of economic uncertainty facing the majority of SMEs, knowing the value of your business could be a key piece of information in determining how it is fairing in the current climate, or if you are considering future plans.

Our specialists can provide you with a detailed commercial valuation, helping you to understand the unique complexities of your business. We can produce independent reports in the context of private company transactions, public listed companies, published indices and the wider economy.

What is the purpose of commercial valuations?

Commercial valuations may be required for a number of strategic purposes ranging from, but not limited to:

- Aiding the decision-making process relating to a group or company restructure.

- Determining the best approach in relation to ownership succession or exit strategy e.g. Employee Ownership Trusts.

- To provide confidence to shareholders.

- Key person insurance to determine a valuation of an owner’s business interest value.

Our commercial valuation reports can provide a deep insight of your business using a variety of tools and techniques at our disposal. Our work includes commentary and key statistics of the sector in which the business trades, to provide wider context of the valuation within the relevant industry.

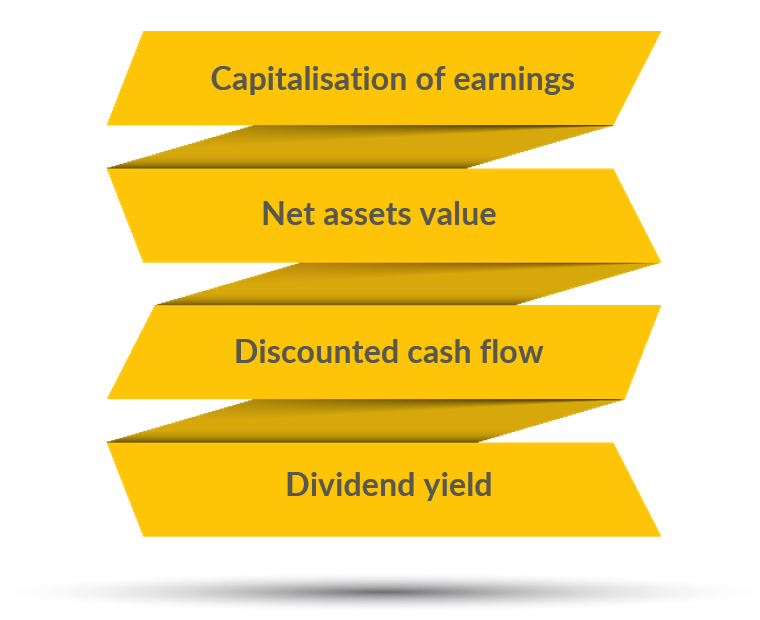

We will consider the characteristics of the subject business to ascertain the most appropriate valuation methodology. We will complete a detailed analysis of historic and future performance to allow us to best estimate future performance, allowing us to provide a robust, well-reasoned valuation.

Case Studies – how can we assist you?

Construction Company Valuation

Situation: We assisted a company in the construction industry that undertakes projects in both the residential and commercial sectors.

Certain shareholders were considering an exit from the company and so our valuation was requested to assist in negotiating a fair and equitable exit for all parties.

Results of the company had fluctuated as a result of Covid-19 and uncertainties regarding compensation in respect of a government environmental scheme. This made it difficult to reliably forecast ‘Future Maintainable Earnings’.

Actions: Through a detailed qualitative and quantitative assessment of the information provided, our valuations team produced a robust valuation report that the shareholders were able to use to help achieve an optimal outcome for all parties.

Purchase Price Allocation

Situation: We were approached by a leading European reproductive medicine and care group to produce a purchase price allocation in respect of its acquisition of a high value UK company. This was required as part of its audit and under IFRS 3 Business Combinations reporting purposes.

Actions: To do this, we had to identify the separate intangible assets within the acquired business. There are a number of methodologies available, but the use of each is dependent upon what is being valued and the availability of comparable information.

Working to a strict timeframe in line with the Group audit overseas, our valuations team produced a comprehensive valuation report. The figures calculated were then reported in the statutory financial statements for the purposes of IFRS 3.

Employee Ownership Trust (“EOT”)

Situation: The shareholders of a family run business operating funeral services in and around London were exploring possible exit opportunities. An EOT was explored due to the tax advantages available and the availability of sufficient capital within the business which could be used as a means of remuneration for the outgoing shareholders.

From a tax perspective, and for governance reasons, it is strongly recommended that a valuation report be produced to arrive at the market value of the shareholding being sold.

Actions: The company had a number of separate activities which added complexity to the valuation work. Regardless, our valuations team produced a robust report, underpinned by supporting research and credentials in the sector, which was used for tax and corporate governance compliance.

Enterprise Management Investment (“EMI”) scheme

Situation: The directors of a business and technology services company operating in the financial sector approached our valuations team to complete a valuation for the purposes of issuing options under the EMI scheme. An EMI scheme, which is approved by HMRC, helps incentivise key employees to grow the business, by enabling them to purchase shares at a specified time and price in the future.

Actions: Our valuations team calculated and agreed a valuation of the company and the options being issued, which enabled key individuals to exercise their options at a point of sale. The company was subsequently acquired which meant key individuals could exercise their options for a substantial gain.