Sadie Channing – Forecasting Specialist

A cashflow forecast enables businesses to track the expected cash movements over a period of time in the future.

Generally speaking, when it comes to future expectations of their profit and loss, business owners tend to know their business inside and out. They know what margin they will make on each product or service that they offer, and have a good understanding of their overheads.

What business owners do not necessarily know inside and out though, is how and when changes (however small) to sales, purchases and other general business costs will affect their bank balance. Whether the impact is positive or negative the phrase ‘turnover is vanity, profit is sanity and cash is king’ has never been so relevant than to the value of cashflow forecasting.

Why is cashflow forecasting important?

It’s important to recognise that a company’s profit at the end of a given month, does not mean that the company has this much cash coming into the business.

Without forecasting a company’s cashflow, it would be almost impossible to estimate how much cash your company will have at a given time. Likewise, if you add to this wages, payroll taxes, VAT, corporation tax payments, loan repayments and other overheads, the situation can become even more complicated!

If you don’t forecast your cashflow, it makes it almost impossible to make informed business decisions, plan for change and know how you can enable business growth.

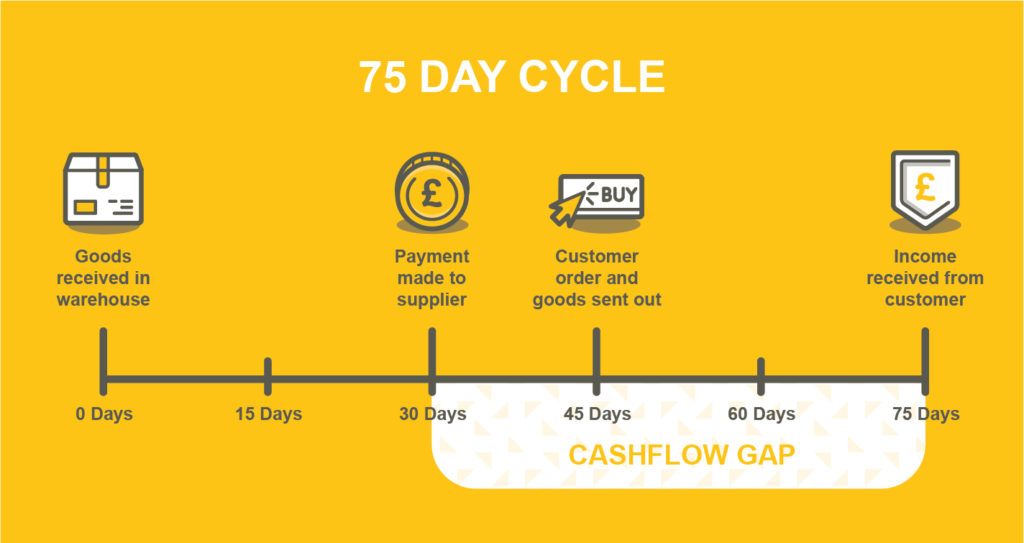

A simple example of why cashflow forecasting is important

– A Company sells Product A.

– They have to purchase Product A from their supplier, and tend to have stock on hand for 45 days before it is sold.

– They are given a 30-day credit period from their suppliers, and they also offer their customers a 30-day credit period.

– Based on the diagram below, there is a gap of approximately 45 days between having to pay for a product, and receiving the income from their customer.

– If this company were to sell multiple other products, all of which had varying lead times, how can the company know how much cash they will have available at any time?

Many businesses that go through tremendous growth, can often find themselves unable to fulfil orders due to a lack of cash and resource available to them. By plotting out the expected cash movements of each element of your business, it will allow you to plan for the future. In our experience, the best performing businesses have a cashflow forecast as a strategic tool.

What is three-way forecasting?

The term ‘three-way forecasting’ refers to the ability to forecast your profit, balance sheet and cashflow altogether, as these are all linked. There are balance sheet movements that have significant effects on a company’s cashflow, which do not appear in a company’s profit and loss, many of which have been described in the next section below.

Why is three-way forecasting so important for a business?

As stated, it is important to understand that not all of the income and costs of a company go through the profit and loss, some aspects of a business’s also affect the company’s balance sheet – for example:

- Income from finance

- Capital purchases

- Capital repayments

- Other types of finance

- Prepayments

- Accruals

- VAT movements

Each of these represent a significant income or payment that a company has to make and without three-way forecasting in place, any one or all of these payments could be missed and would likely cause extreme pressure on cashflow.

Is there a benefit to tracking your businesses forecasts against actual results?

Some people think that there is no benefit of comparing actuals against budgets, as it has already happened and there is nothing that can be done about it.

In fact, this is quite the opposite. By comparing forecasts to actuals, businesses will gain a better understanding of why they are not hitting certain targets, or overspending in certain areas. This will empower businesses to implement changes and create efficiencies.

The types of questions this review may raise are:

- If sales were not achieved in a given month, why was this?

- Is there a certain customer who is buying less from us now, why?

- What can we do to improve this relationship, so they don’t go elsewhere?

- Our gross profit margin is less than expected, why was this?

- Is there a certain supplier that has increased their costs?

- How much manpower is used for this product/supply, is it still a profitable product?

- Repairs and maintenance costs were much higher than budgeted, did we see this coming, and should we have updated our forecasts for this?

5 tips when creating your three-way forecast

1. Compare your budget to recent actual results.

- Does this budget look realistic, or unachievable?

- Are you missing any major costs?

2. Do not forget about expenditure that you may not see on your profit and loss – many business outgoings do not appear on the profit and loss:

- Capital purchases

- Loans

- Capital repayments

- Other types of finance

- Prepayments

- Accruals

- VAT movements

3. Think about your assumptions carefully, do not use a broad brush approach as most businesses are not that simple:

- Is 20% VAT applied to all purchases and all sales? If this is not the case then it is not appropriate to apply this assumption.

- Are all debtors on sales received within 30 days? Whilst this may be the credit terms that are given to customers, is this truly how they pay us?

4 . Review your forecast balance sheet over a period of time and check each line carefully, do the figures start to look very unrealistic in a short space of time?

- Have trade debtors increased by 100%, but sales have only increased by 5%? This suggests the assumptions used are not true of reality.

5. Always compare your budgets with actuals on a line by line basis in a timely manner. This will ensure you are picking up any issues with spending and income and can address them accordingly.

Need help with cashflow forecasting?

Good cashflow is essential to help a business grow, so why wouldn’t you want to predict expenditure and be prepared for all eventualities? We have a range of simple and advanced cashflow forecasting solutions, all of which aim to to support your business in the right decisions based on the right data.

You can find out more about our business forecasting services here.

If you have any questions or would like to speak to us about how we could help you, please contact Sadie Channing by email schanning@menzies.co.uk or by phone 01252 541244.