As someone who both lives and works in London, it is difficult to escape the palpable sense of shock at the rapid escalation of events. The news flow is consistently grim and one can’t begin to imagine the increasing challenge faced by those working in our health service – ‘heroic’ does not begin to do justice.

As Chancellor Merkel said, ‘Es ist ernst’ (it is serious).’ However, for the purposes of both this market commentary and our role as your financial advisers, I think it is important that I omit the emotion and provide you with a ‘cold’ analysis of the financial impact.

The first question you might reasonably ask is whether we should we be viewing current events in the context of the comparatively recent Global Financial Crisis (GFC) of 2008/09?

The Global Financial Crisis (GFC)

The GFC was a balance sheet recession triggered by a collapsing housing sector and a capitulation of confidence in banks. Housing is the biggest source of consumer wealth, so big price falls or lending squeezes can trigger structural slowdowns. There have been only two housing busts in the US in recent memory, in 1929 and 2008-09. Both of these led to significant and prolonged economic slowdowns and it took a long time for the system to heal and the economy to recover to its potential. This time, the travel, tourism and retail sectors are the most vulnerable, but history suggests that the overall time to recovery could be shorter.

So if not the GFC, then to which financial crisis should we look for lessons?

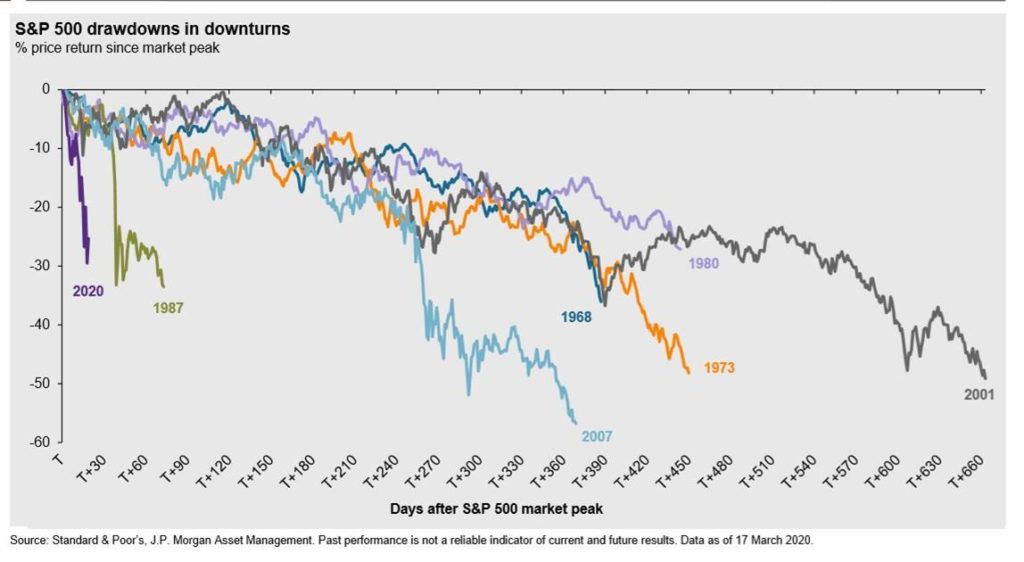

What is clear is that over the last few weeks we have seen a far more rapid and pronounced sell-off across global stock markets than was the case during the GFC or even the Dot.com Bubble. As the chart below illustrates the closer parallel is perhaps the stock market crash of 1987, also known as Black Monday.

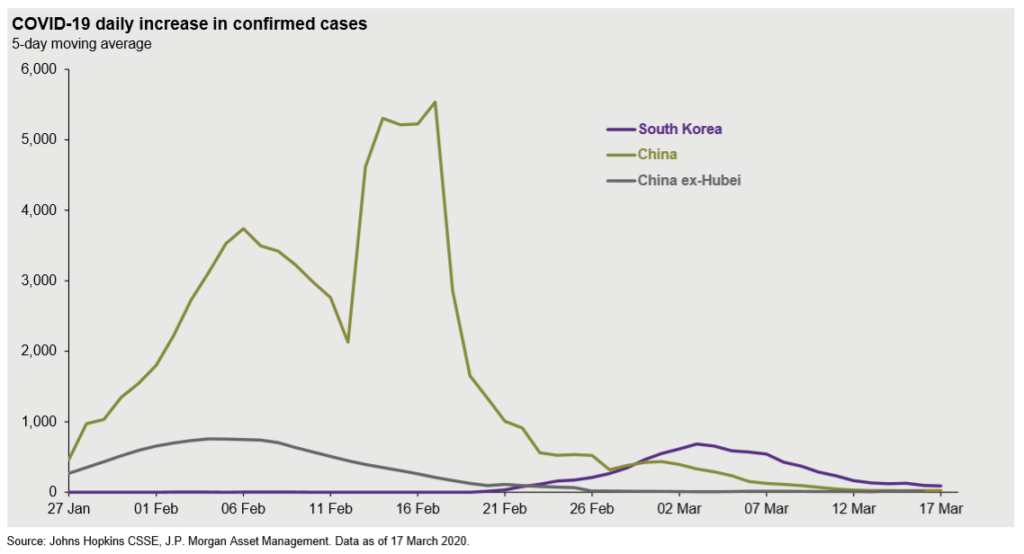

One school of thought is that the recent market volatility associated with Covid-19 is an ‘event’ based crisis and is perhaps more comparable to the 1918-19 pandemic flu. The resulting recession lasted only seven months, despite the second wave of infections in autumn 1918 being more deadly than the first. During the 1918-19 pandemic, already reeling from a world war, a third of the population was infected, with some 5 per cent of the global population dying. We are already in the second month of this event and while health systems throughout the world are much better organised than they were in 1918, it remains to be seen how the virus will progress and how soon it will be contained. Though the risk of a second wave of infections remains, China’s new case data has improved every week since the start of March, and the country seems close to normalising in several areas.

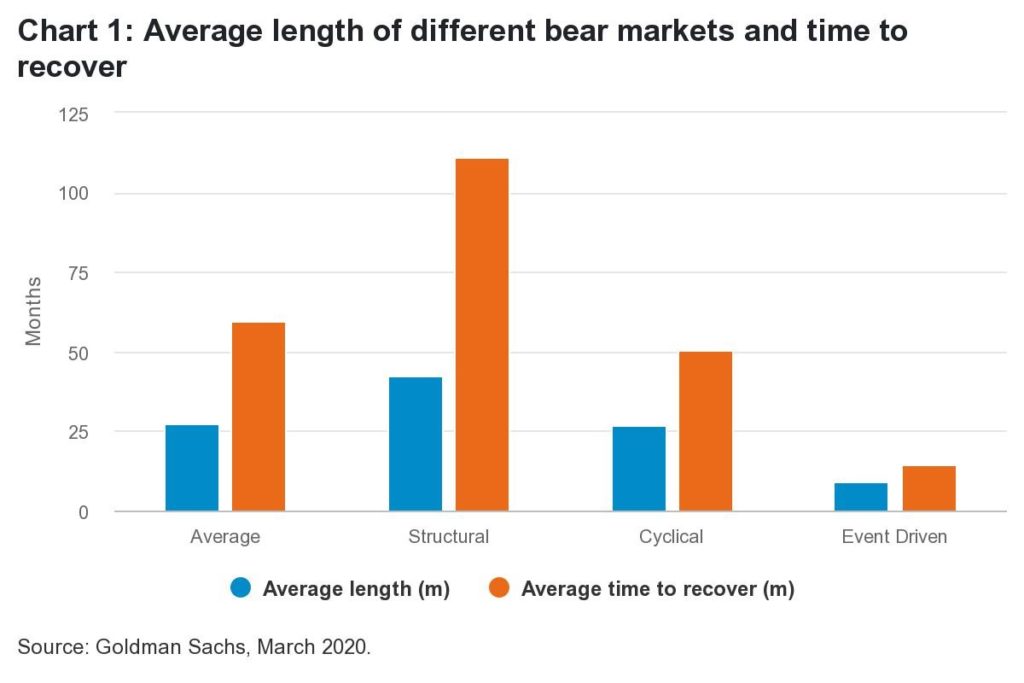

With this in mind it is perhaps useful to consider the extent of past ‘event’ based crises versus structural and cyclical ones. In short ‘event’ driven crises are likely to result in bear markets and recoveries that are shorter in nature than those that are cyclical or structural. (It is also worth remembering that by its nature, the GFC was a financial led crisis, which is known to be longer and deeper). The Governor of the Bank of England echoed this view in his interview with the BBC yesterday where he implored employers to look at Government & Banking support before shedding their workforces. The point of principle is that the priority for governments and central banks is to ensure that companies can continue to employ their staff and maintain their inventories such that they can return to full production once the present crisis has passed.

Which sector will take the biggest impact?

Hospitality & Leisure sector

The most immediate impact from virus containment measures has been felt in the travel and tourism sector. Little doubt the knock-on effects will be significant with the sector employing 10 percent of the global workforce and accounting for a little over 10 percent of the global economy. The World Travel and Tourism Council suggest that it takes an average of around 19.4 months for the sector to recover from epidemics, which compares to 11.5 months for terrorist attacks. All of the following will suffer – airlines, cruise liners, hotels, restaurants (and their associated supply chains) – and it will take some time before they normalise.

Retail & Wholesale sector

Traditional retail was already seriously challenged and will clearly suffer further as footfall is significantly impacted by the restriction on movement. The decline in consumer confidence and increase in credit stress greatly increases the likelihood of such businesses failing. Economic data from 1918-19 is understandably scarce but a 2007 study of the 1918 pandemic by the St Louis Federal Reserve provides some interesting insight, gleamed from newspaper articles of the day. Merchants suggested that their business decreased by 40-70 percent during the outbreak, while retail groceries fell by one-third. Unsurprisingly perhaps, the only business in Little Rock that saw an increase in activity that year was the pharmacist.

Business and Financial Services sector

Financials, particularly banking stocks have been hurt and are trading below their book value. This means that their dividend yields are markedly higher than yields on US treasuries. We are seeing similar actions by investors, as occurred during the GFC, yet the banking system is better capitalised and more resilient than it was in 2008.

Manufacturing Sector

Industrials, meanwhile, had already started to recover from a slowdown and have seen this all before. With China starting to come back and inventories drawn down in the system, I expect Industrials to recover faster than consumer sectors over the next six months. And with over 75 percent of equities overall offering higher yields than US treasuries – a record high – the risk/reward ratios are looking more favourable over the medium term, as we weigh up the economic impact of the virus versus the magnitude of the monetary and fiscal response.

What is likely to lead to an improvement in markets?

As we have discussed on previous occasions, ‘sentiment’ can have a big impact on markets, and at this point, we are really looking for things that will help improve sentiment.

With this in mind I think we are looking for two things:

- Clearly signs that the infection rate is peaking would help. In this regard the news from China is seemingly improving (as the chart illustrates) albeit we have some way to go yet in Europe and the US.

- An effective fiscal and monetary response. The operative word being ‘effective’ as the persistent market volatility suggests that market participants are as yet unmoved by the measures enacted so far by central banks and governments.

The current economic outlook is far from certain. Measures have been implemented across the world in an attempt to slow the spread of Covid-19 and the chart below suggests some success in slowing the virus. The measures will have an economic impact, but as the extent of that impact is not certain, markets have reacted accordingly with pronounced volatility. We expect market volatility to remain elevated until there is a fundamental change in sentiment.

It is understandable that individuals might be unsettled by such short term volatility, however investors should take some comfort from the knowledge that event driven crises will likely have a shorter bear market and a quicker time to recover. A focus on the fundamental plan will also be important.

Matters continue to evolve rapidly, indeed during the time I have spent writing this commentary, the Bank of England have took further action to cut the base rate to 0.1% and increased their bond buying programme by an additional £200billion. We will continue to update you regularly and I know many of you have already had a phone call from your Financial Planner. Please do not hesitate to contact me or your Financial Planner at any time of day or night should you wish to discuss either our market commentary or your investment portfolio(s).

Disclaimer

This document (market commentary) is intended for general information purposes only and does not constitute advice. It is based on our current understanding of legislation, which may be subject to change. Menzies Wealth Management can accept no responsibility for any loss resulting from acting or refraining to act as a result of any material in this publication. Past performance is not a guide to future performance and the value of investments may fall as well as rise. Personal taxation will depend on individual circumstances. The Financial Conduct Authority does not regulate taxation and trust advice, or some types of mortgage.

Menzies Wealth Management

Lynton House, 7-12 Tavistock Square

London, WC1H 9LT

T: 020 7387 5868

E: advice@menzieswm.co.uk

Menzies Wealth Management is authorised and regulated by the Financial Conduct Authority 486548