What is R&D Tax Relief?

A corporation tax relief introduced back in 2000 to incentivise innovative UK businesses to invest in R&D and create advances in science and technology.

What is the definition of R&D?

The legislation and HMRC guidance are intentionally not too prescriptive so as not to discourage genuine claims. Essentially R&D takes place when a project is undertaken that seeks to achieve an advance in overall knowledge or capability in science or technology. This can be in relation to a new product/process or improvements to an existing product/process.

What is the relief available

This depends under which R&D scheme you claim.

The UK currently has two R&D schemes – the SME scheme for qualifying small and medium sized businesses, and the RDEC scheme for large businesses and SMEs that don’t meet the conditions for the SME scheme.

On 1 April 2023, the rates of relief were dramatically cut for the SME scheme but increased for the RDEC scheme.

Further change is expected for periods starting on or after 1 April 2024, when the two schemes are merged into a single scheme to promote simplicity and promote further R&D claims… except that it has been decided that a further scheme should also be introduced to provide an enhanced rate of relief to loss-making R&D-intensive companies!

All clear?

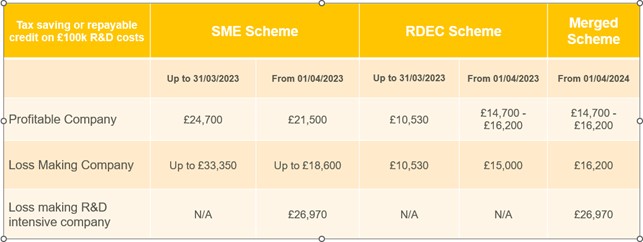

To help clarify this point, the following table provides details of the tax saving or repayment credit resulting from £100,000 of qualifying expenditure.

Common R&D tax relief questions

HOW DO I KNOW WHICH SCHEME I SHOULD CLAIM UNDER?

Before 1 April 2024 – SME Or RDEC Scheme?

In order to claim under the SME scheme, you must meet the following criteria when taking into account all linked and partner enterprises:

• Less than 500 employees and

• Less than €100m turnover or

• Less than €86m gross assets

If the R&D work has been subcontracted to you or has been awarded funding (for example, grants) you may be unable to claim under the SME scheme but could still make a qualifying RDEC claim.

Post 1 April 2024 – Merged Scheme or Loss-Making R&D Intensive Scheme?

The default position is that companies should claim under the merged scheme. However, a company may be able to claim a higher rate of relief under the R&D intensive scheme if it is

i) An SME

ii) loss making

iii) ‘R&D-intensive’, meaning that qualifying R&D expenditure makes up at least:

a. 40% of its total costs for periods starting on or after 1 April 2023

b. 30% of its total costs for periods starting on or after 1 April 2024

Total expenditure is calculated from the total costs in the profit and loss (P&L) account, less any amounts not deductible for tax purposes, plus any capitalised R&D costs claimed under s1308 CTA 2009. If a company has multiple connected companies, the aggregate of their costs should be considered.

The rules provide for a ‘year of grace’ so that companies with fluctuating levels of R&D would have to fail to meet the R&D intensity threshold for 2 years in a row before moving back to the merged scheme.

WHAT IS QUALIFYING R&D EXPENDITURE?

• Staff costs including gross salary, employers NIC and employers pension contributions

• Subcontractors / Externally Provided Workers

• Consumables including water, fuel and power

• Software

DOES AN R&D PROJECT HAVE TO BE SUCCESSFUL AND COMPLETE IN ORDER TO MAKE A CLAIM?

No, providing you are seeking advances in science or technology and are carrying out R&D to do so you can claim from the point at which the project begins. The project does not to need to be successful in order to make a claim and you can claim for failed projects.

IS THIS RELIEF ONLY FOR SCIENCE AND TECHNOLOGY TYPE COMPANIES?

This is not just a relief for “men in white coats” and although pharmaceutical and software development companies will make claims, we have made claims in all sectors including manufacturing, property and construction, transport and logistics, hospitality and leisure.

HOW LONG DO I HAVE TO MAKE A CLAIM?

You have 2 years after the accounting period end to make an R&D claim after which time the period is closed for making claims.

Please note however, that if you have not previously made an R&D claim or have not made one for three years, then you must submit advance notification of your intention to make an R&D claim within just 6 months of the end of the accounting period in question.

DO I HAVE TO MAKE A PROFIT AND PAY CORPORATION TAX TO MAKE A CLAIM?

No – even if your company is loss making it can still make a claim and receive a tax credit repayment, even if you have never paid corporation tax.

IF I HAVE RECEIVED OTHER GRANTS WILL THIS IMPACT THE R&D CLAIM?

Potentially, this will depend on the nature of the grant and whether it is classified as notified state aid. Even if you have received grant funding for R&D projects you could still make a claim under the large scheme.

The good news is that for periods starting on or after 1 April 2024, there will be no restrictions due to funding of the R&D

CAN SOLE TRADERS AND PARTNERSHIPS CLAIM R&D TAX RELIEF?

No – only companies liable to corporation tax can make an R&D claim.

HOW ARE R&D CLAIMS MADE?

HMRC set out mandatory information that must be provided to support that an R&D claim meets the required conditions, including details of the projects undertaken and the associated R&D expenditure. This information is submitted via HMRC’s online ‘Additional Information Form’ (AIF).

The details of the amount claimed for relief must then be entered into the company’s tax return (the tax computations, form CT600 and supplementary form CT600L). The AIF must be submitted before the tax return containing the R&D claim is submitted, or HMRC have the power to simply remove the R&D claim.

HOW LONG DO HMRC TAKE TO PROCESS R&D CLAIMS AND ISSUE ANY REPAYMENTS DUE?

HMRC normally look to process claims within 28 workings days of receipt.

WHAT ARE YOUR FEES FOR PREPARING R&D TAX RELIEF CLAIMS?

This will vary depending on the scope and complexity of your claim, however our expert team would be happy to have a call with you to discuss your work in more detail and provide you with an indicative quote.

If you are comfortable preparing your own claims, but are concerned at the level of change in the rules and the increasing level of compliance activity from HMRC, or simply wish to ensure that you are claiming the full amount you are entitled to, we are happy to discuss undertake detailed reviews of your claims.